The Dow dropped a total of 1175.21 points today in heavy trading. This is the biggest single day drop IN HISTORY. Trump was trumpeting the fact that the market was setting all kinds of records and took plenty of credit for this when it had little to do with his actions, or with those of any other human. The economy has a mind of its own.

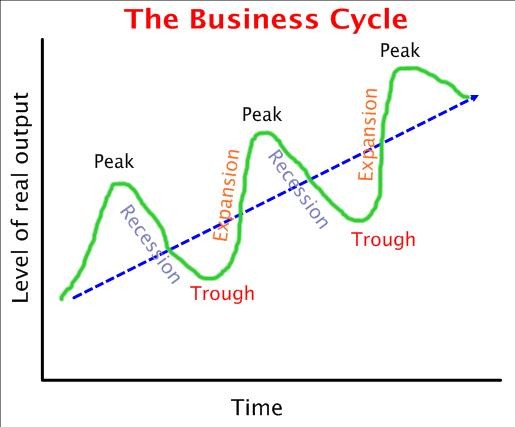

The Business Cycle goes through periods of expansion/inflation, recession, troughs and peaks. The Federal Reserve regulates open market operations by which government bonds are bought or sold in order to respectively increase or decrease the money supply. In other words, when the Federal Reserve decides to buy bonds from individual consumers, businesses and corporate entities, it is attempting to put money in people’s’ pockets to help combat a real or anticipated recession.

Alternately, during periods of inflation, in order to curb the money supply, the Reserve, the equivalent of our Bank of Canada, will sell bonds, thus taking money out of peoples’ pockets. In this situation, people exchange money for government bonds.

The Reserve and the BOC (Bank of Canada) also use interest rates to control the money supply. During periods of expansion during the Business Cycle, the Bank Rate will be raised while during periods of economic contraction, the Bank Rate (BR) will be lowered, making it more attractive to borrow and spend money, thus assisting in economic expansion.

A third way the Reserve and the BOC operate to control the money supply is through a policy of moral suasion.

The government itself, through its spending and taxation policies also operates as an economic regulator. Increased taxation coupled with decreased government spending would be the methodology used to combat inflation and decreased taxation coupled with increased spending would be introduced to fight recession.

Even with all this, the ups and downs of the Business Cycle march on. All the government and the Reserve/ BOC can accomplish is to attempt to ensure that the ups and downs are less severe than they would be in the absence of government intervention in the economy.

Trump is an idiot to take credit for a good economy or, by the same token, to take the blame for what has happened to the Stock Market in the last three or four sessions. But the moron obviously doesn’t see it that way which means he can be blamed for the LARGEST POINT DROP for the Dow in HISTORY, if he has taken credit for the Market’s positive performance since the 2016 presidential election, which he definitely has.

Just to repeat, the economy moves in cycles. Intervention can be used to even out the ups and downs. However, they cannot be eliminated. Eat shit, Moron-In-Chief.

Inflation is an economic situation where too much money is chasing too few goods which drives prices up due to the laws of supply and demand. In this case, demand for goods bids up prices causing increased inflation, rising prices with the result that the purchasing power of the money falls.

Recession results from an antithetical scenario, in which there is not enough money around which causes prices to either rise less quickly, stabilize or fall. Less demand results in increased rates of unemployment, so characteristic of recessionary periods in the Business Cycle.

That’s all folks.

Peace out.

One response to “Stock Market Juice [02/05/2018]”

Like it JC!